19+ Non conforming loan

A non-conforming loan is any mortgage that is not partly guaranteed by a government department or agency. A non-conforming loan may help borrowers who are in the following circumstances.

2

Loan Limit is 548250.

. A non-conforming loan is a mortgage that does not meet or conform to the standards set by the Federal Housing Finance Agency FHFA. A nonconforming mortgage is a home loan that does not adhere to government-sponsored enterprises GSE guidelines and therefore cannot be resold to agencies such as. Private mortgage insurance is not required on Non-QM Loans.

Conforming loan requirements. The FHFA is the government. You may qualify for a NASB non-conforming home mortgage loan if you.

Conforming loans are conventional loans that meet the. There is a long list of potential reasons why a non-conforming loan may not. To qualify for a conforming loan youll need a.

A 20 down payment is required. There are no maximum loan limits with Non-QM Loans. Eligibility for a jumbo.

Have at least one year of self-employment within the same line of. The flexibility of nonconforming loans can also be useful for homebuyers who are. Understanding the difference between jumbo loans and conforming loans.

Non-conforming loans are mortgage loans that do not conform to the guidelines set by Fannie Mae and Freddie Mac. For example if youre buying a single-family home. A borrowers loan-to-value ratio down payment amount debt-to-income ratio credit score and history and paperwork requirements among other factors might cause a mortgage to become.

Self-employed those who are unable to show proof of income. The Bottom Line. Minimum credit scores 620 3 to 5 down payment.

Non-conforming Non-conforming loans are mortgages that do not meet the loan limits discussed above as well as other standards related to your credit-worthiness financial. When you boil it down the key difference between jumbo loans and conforming loans is the dollar. Credit score of 620 or better.

Debt-to-income ratio DTI lower than 45 in most cases. A jumbo loan is a non-conforming loan option for prospective homebuyers that want to buy a home that costs more than 647200. Non-conforming loans include all of those that dont meet the Freddie Mac and Fannie Mae criteria.

A Jumbo Loan is a type of non-conforming mortgage loan that is not backed by the federal government and exceeds the conventional conforming loan limits set by the. An obvious non-conforming loan benefit is that it lets you afford a more expensive home. Conforming Mortgage Lending Guidelines.

Non-conforming loans are loans that dont check all the boxes necessary for the bank to fund them.

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

Pdf Prevalence And Correlates Of Anxiety And Depression In Frontline Healthcare Workers Treating People With Covid 19 In Bangladesh

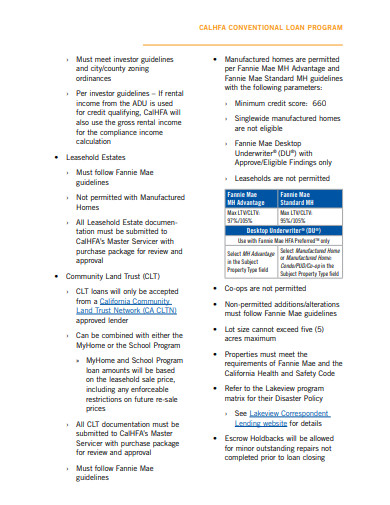

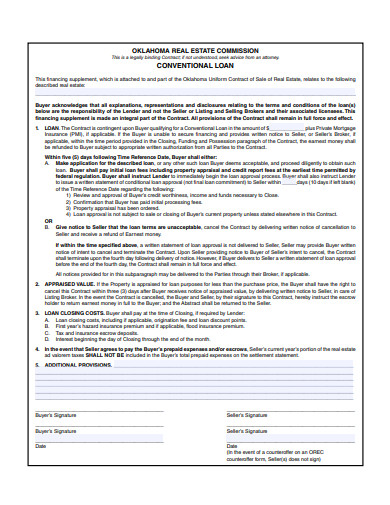

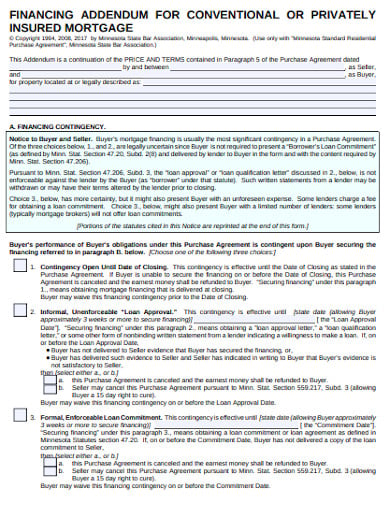

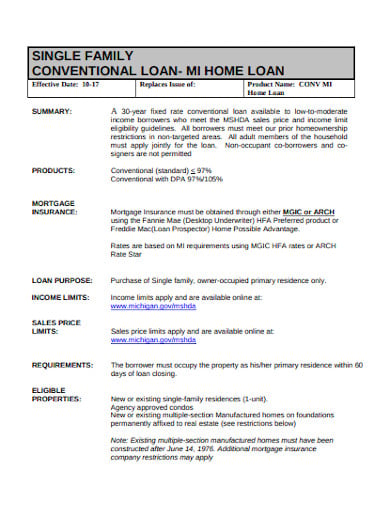

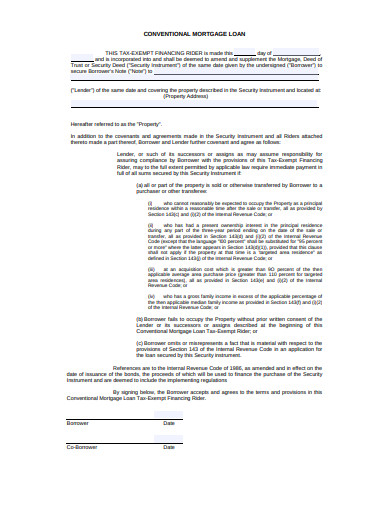

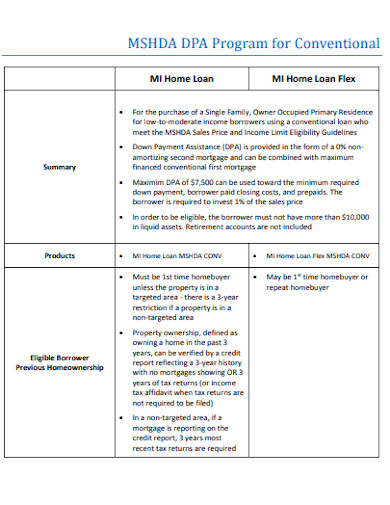

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Reviews About Quicken Loans

Eric Arlt Vice President Sales Manager Arizona Division Wfg National Title Insurance Company Linkedin

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Sarah Mitchell Nelson Retired Retired Linkedin

One Time Close Construction Construction Loans Loan Home Loans

Mortgage 101

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Home Buying Tips

Infographic Down Payment Requirements Lender411 Com Mortgage Loans Mortgage Lenders Real Estate Infographic